Tax Group | Annual Report

1

—

Tax Group

Melbourne Law School

Annual Report

2017

Tax Group | Annual Report

2

Contents

About the Tax Group ……………………………………………………………………………………………………………………………… 3

Centre Directors and Faculty ………………………………………………………………………………………………………………….. 3

Adjunct Faculty ………………………………………………………………………………………………………………………………………. 6

Advisory Board Members ……………………………………………………………………………………………………………………….. 7

Visitors …………………………………………………………………………………………………………………………………………………… 8

The Tax Program ……………………………………………………………………………………………………………………………………. 9

Melbourne Law Masters (MLM) in Taxation ………………………………………………………………………………………. 9

JD Elective Subjects ……………………………………………………………………………………………………………………………. 10

Breadth Subjects ………………………………………………………………………………………………………………………………… 10

Events …………………………………………………………………………………………………………………………………………………….. 11

Publications ……………………………………………………………………………………………………………………………………………. 13

Media …………………………………………………………………………………………………………………………………………………….. 14

Tax Discussion Group ……………………………………………………………………………………………………………………………… 15

Tax Group | Annual Report

3

About the Tax Group

The Tax Group aims for excellence in tax education and research. We teach a wide range of subjects

in postgraduate and undergraduate tax programs, carry out tax research with a technical, public

policy and reform focus and contribute to public debate on taxation issues. Our education program

is designed and taught by, and in conjunction with, experienced taxation practitioners including

members of leading law and accounting firms and leading members of the Bar.

Research interests in the tax faculty are diverse and include Australian individual and corporate

income tax, comparative and international taxation and critical perspectives on taxation. Much of

the research work carried out by the Tax Group is interdisciplinary and comparative in nature.

The Tax Group at Melbourne Law School is pleased to host the Annual Tax Lecture and Australian

branch meetings of the International Fiscal Association. The Tax Group has strong international tax

connections including with New York University; the University of Virginia in the USA; Oxford

University Centre for Business Taxation at the Said Business School; and the Cambridge University

Law School Centre for Tax Law. We welcome international students in the postgraduate tax

program.

Centre Directors and Faculty

Director

Associate Professor Sunita Jogarajan

Dr Sunita Jogarajan is Co

-Director of the Tax Group at

Melbourne Law

School, where she teaches and researches in taxation law. Sunita's primary

research interest is in the influence of the League of Nations on

international taxation, particularly the development of model tax treaties.

Sunita also researches in

Australian corporate tax and tax administration.

She has previously written on the role of the IMF on tax reform and the

integration of tax regimes in ASEAN member countries.

Sunita previously worked at a 'Big 4' tax practice in corporate tax and tax

poli

cy. She has been involved in a multi-

billion dollar international due

diligence, engagements for regional governments and policy advice.

Sunita is a previous recipient of an Australian Learning and Teaching Council

citation for 'outstanding contribution t

o student learning'.

Tax Group | Annual Report

4

Director

Associate Professor Mike Kobetsky

Dr Michael Kobetsky is an Associate Professor at Melbourne Law School.

He is an Adjunct Professor at the Australian National University College of

Law.

Dr Kobetsky researches in transfer pricing, tax treaties, international anti

-

avoidance measures and domestic taxation, and he is the principal author

of one of Australia’s leading taxation texts, which is now in its ninth edition

(2016). His book, titled 'International Taxation of Permanent

Establishments: Principles and Policy' was published by Cambridge

University Press in 2011. Dr Kobetsky has published extensively on

international taxation in journals in Australia, Canada and Europe.

Dr Kobetsky is a m

ember of the United Nations Sub-

Committee on

Transfer Pricing and the United Nations Sub

-

Committee on Extractive

Industries Taxation Issues for Developing Countries. He has worked as a

consultant for the OECD, USAID in Nepal, the World Bank in Indonesia, a

nd

GIZ (Deutsche Gesellschaft für Internationale Zusammenarbeit or German

Society for International Cooperation which is the German government’s

foreign

-aid organization) in Laos and Malawi.

Dr Kobetsky has 10 years’ experience as a senior executive office

r with the

Australian Taxation Office in their policy and legislation group designing

and implementing tax law and policies.

Member

Associate Professor Mark Burton

Dr Mark Burton has worked in the field of taxation law for more than 20

years: in private practice and also as an academic. Mark has taught

extensively in the taxation law field at undergraduate, graduate and

postgraduate levels. Mark has undertaken consultancies with the

Australian Taxation Office and also with the Australian National Audit

Office.

Mark’s research and scholarship on tax matters have been published both

within Australia and internationally. This research spans technical tax

issues, the the

ory and practice of tax administration, the ethical aspect of

taxation law, tax policy and the tax legislative process. Mark is co

-author of

Understanding Taxation Law

, LexisNexis, 2017 and

Tax Expenditure

Management

– A Critical Assessment, Cambridge University Press, 2013.

Mark completed his PhD (Law) at the Australian National University, and

his doctoral dissertation examined the theory, history and practice of

interpreting tax legislation.

Tax Group | Annual Report

5

Member

Professor Miranda Stewart, Faculty

Miranda Stewart is currently part

-

time at the Faculty, while being

Director of the Tax and Transfer Policy Institute, Crawford School of

Public Policy, Australian National University. Miranda teaches and

researches across a broad range of tax law and poli

cy topics including

business taxation, tax and development, not

-for-profits, and tax reform

in the context of globalisation. She is an author or editor of several

books, including

Not for Profit Law (Cambridge Uni Press, 2014, with

Harding and O’Connell),

Sham Transactions

(Oxford University Press,

2013 with Simpson),

Tax, Law and Development (Edward Elgar, 2013,

with Brauner),

Death and Taxes(Thomson Reuters, 6th ed., 2014 with

Flynn),

Income Taxation Commentary and Materials (Thomson Reuters,

8

th

ed., 2017 with Cooper, Dirkis and Vann) and

Housing and Tax

Policy

(Australian Tax Research Foundation, 2010). Miranda has been a

visiting fellow at NYU School of Law, NY

USA and at Christ Church, Oxford

on the Melbourne

-Oxford Faculty Exchange and is an International

Research Fellow with the Centre for Business Taxation at Oxford

University. Miranda was a Consultant to the Henry Tax Review into

Australia's Future Tax System. Before joining the Faculty in 2000,

Miranda taught at NYU in the leading International

Tax program in the

US and previously worked in the Australian Tax Office on tax policy and

legislation and as a solicitor in a large law firm. She has taught in the

graduate tax programs at Osgoode Hall Law School and the University of

Toronto, Canada; an

d the University of Florida Levin College of Law,

United States.

Centre Administrator

Ms Cindy Halliwell

Cindy Halliwell joined the University of Melbourne in 2010, as

Communications co-ordinator for the Centre for Aquatic Pollution

Identification and Management (CAPIM) in the Faculty of Science. In

2015 she joined the Melbourne Law School as Research Centre

Administrator for several research centres, including the Tax Group.

Cindy brings administrative and project management experience from

the airline and finance industries. She holds a Bachelor of Arts in Public

Relations/ Tourism, a Graduate Diploma in Business Administration and

currently undertaking a Bachelor of Laws.

Tax Group | Annual Report

6

Adjunct Faculty

Mr Daniel Butler, DBA Lawyers

Professor Lee Burns, University of Sydney

Mr Michael Charles, Deloitte

The Hon. Justice Jennifer Davies, Federal Court of Australia

Mr Andrew de Wijn, Victorian Bar

Mr Aldrin De Zilva, Greenwoods and Herbert Smith Freehills

Mr Michael Evans, Taxsifu

Mr Bryce Figot, DBA Lawyers

Mr Michael Flynn, Victorian Bar

Mr Martin Fry, Allens

Mr Peter Gillies, Pitcher Partners

Mr Stewart Grieve, Johnson Winter & Slattery Lawyers

Professor Peter Harris, University of Cambridge

Ms Michelle Herring, JGL Investments Pty Ltd

Mr Paul Hockridge, Mutual Trust

Mr Ron Jorgensen, Rigby Cooke Lawyers

Mr Nasos Kaskani, Victorian Bar

Mr Terry Murphy QC, Victorian Bar

Mr Tim Neilson, Greenwoods and Herbert Smith Freehills

Mr Frank O’Loughlin, Victorian Bar

Mr Adrian O’Shannessy, Greenwoods and Herbert Smith Freehills

The Hon. Justice Tony Pagone, Federal Court of Australia

Mr Gareth Redenbach, Victorian Bar

Professor David Rosenbloom, New York University

Ms Shannon Smit, Transfer Pricing Solutions

Mr Greg Smith, Australian Grants Commission

Mr Philip Solomon QC, Victorian Bar

Mr Eugene Wheelahan, Victorian Bar

Mr David Wood, King & Wood Mallesons

Tax Group | Annual Report

7

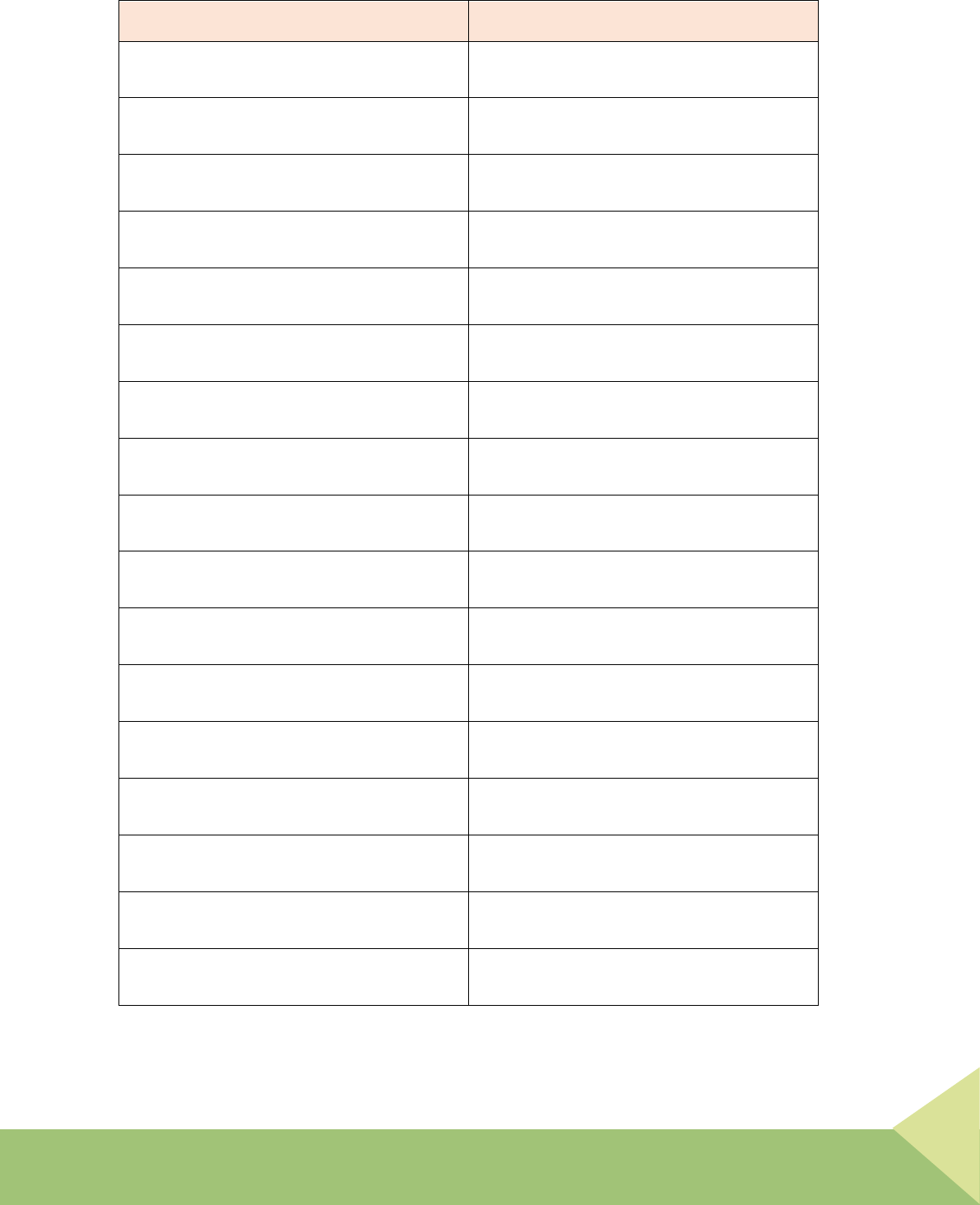

Advisory Board Members

Member Name

Organisation

Andrew Clements

King & Wood Mallesons

Angela Wood

KPMG

Daniel Butler

DBA Lawyers

Fiona Dillon

Australian Delegate to the OECD

Frank O'Loughlin

Victorian Bar

Helen Symon QC

Victorian Bar

James Fabijancic

Deloitte

Jennifer Batrouney QC

Victorian Bar

Justice Jennifer Davies

Federal Court of Australia

Mark Burton

Melbourne Law School

Michael Jenkins

Australian Tax Office

Mike Kobetsky

Melbourne Law School

Niv Tadmore

Clayton Utz

Peter Gillies

Pitcher Partners

Sunita Jogarajan

Melbourne Law School

Terry Murphy QC (Chair)

Victorian Bar

Tim Neilson

Greenwoods + Herbert Smith Freehills

Tax Group | Annual Report

8

Visitors

Dr Jonathan Barrett

Senior Lecturer

Victoria

University of Wellington

Jonathan Barrett’s research interests include taxation theory and role

of human dignity in everyday situations. His PhD

applied fundamental

human rights to a taxation system. Jonathan is also interested in the

theory and practice of teaching law to non

-vocational students.

Professor Michael Littlewood

Professor

University of Auckland

M

ichael is a New Zealander but has spent many years in Hong Kong. He

has degrees in law and politics from the University of Auckland and a

doctorate in tax law from the University of Hong Kong. He is admitted

as a barrister and solicitor in New Zealand, as a solicitor in England and

Wales a

nd as a solicitor in Hong Kong. He is an authority on New

Zealand tax law, Hong Kong tax law, tax policy and tax history. Much of

his work has been in the fields of tax planning, tax avoidance and

international tax. His work has been published and cited in

leading

journals in New Zealand, the US, the UK, Australia and Hong Kong. He

is a fulltime academic but has also from time to time provided advice

to business interests and to the governments of several countries.

Professor Lisa Marriott

Professor

– School of Accounting and Commercial Law

Victoria

University of Wellington

Lisa Marriott

is Professor of Taxation at Victoria University’s School of

Accounting and Commercial Law. Her research interests include social

justice and inequality, and the behavioural impacts of taxation.

Lisa has

worked in the private sector in the UK and the publ

ic sector in New

Zealand. Since 2008 she has worked in academia.

Tax Group | Annual Report

9

The Tax Program

Melbourne Law Masters (MLM) in Taxation

Subject Name

Lecturer/s

Capital Gains Tax: Problems in Practice

Mark Burton, Michael Flynn

Capital Gains Tax: Problems in Practice

Mark Burton, Michael Flynn

Comparative Corporate Tax

Peter Harris

Comparative International Tax

Lee Burns

Comparative Tax Avoidance

Tony Pagone, Eugene Wheelahan

Corporate Tax A (Shareholders, Debt and

Equity)

Frank O’Loughlin, Stewart Grieve, Nasos Kaskani

Corporate Tax A (Shareholders, Debt and

Equity)

Frank O’Loughlin, Stewart Grieve, Nasos Kaskani

Corporate Tax B (Consolidation and Losses)

Aldrin De Zilva, Michael Charles

Foundations of Tax Law

Mark Burton, Miranda Stewart

Foundations of Tax Law

Mark Burton, Miranda Stewart

Goods and Services Tax Principles

Michael Evans

International Tax: Anti-avoidance

Lee Burns

International Tax: Principles and Structure

Michael Kobetsky, Peter Gillies

International Taxation in the US

David Rosenbloom

Tax Policy

Greg Smith

Tax Practice: Writing Effectively

Jennifer Davies, Ron Jorgensen, Philip Solomon QC

Tax Treaties

Michael Kobetsky

Taxation of Business and Investment Income

Michelle Herring, Tim Neilson

Taxation of Business and Investment Income

Lee Burns

Taxation of Major Projects

Gareth Redenbach, Martin Fry, Tim Neilson, David Wood

Tax Group | Annual Report

10

Subject Name

Lecturer/s

Taxation of Small and Medium Enterprises

Peter Gillies, Paul Hockridge

Taxation of Superannuation

Bryce Figot, Daniel Butler

Taxation of Trusts

Terry Murphy QC, Andrew de Wijn, Adrian O’Shannessy,

Gareth Redenbach

Transfer Pricing: Practice and Problems

Michael Kobetsky, Shannon Smit

JD Elective Subjects

• Taxation Law and Policy (JD)

• Legal Research

Taxation: Theory and Practice (Semester 2)

Breadth Subjects

These subjects are taught to non-law undergraduate students and exchange students undertaking

undergraduate law degrees

• Taxation Law I

• Taxation Law II

Tax Group | Annual Report

11

Events

SEMINAR: 5 April 2017

Held jointly with the International Fiscal Association

(IFA) at the Federal Court of Australia

Panel discussion on Taxpayer Rights with special guest Ali Noroozi, Inspector-General of Taxation,

following the release of the IGT report on this topic. Helen Symons QC prepared IFA national report

on the topic for the IFA Congress and other panellist were leading experts from the legal profession

and Australian Tax office, including Andrew Mills, Second Commissioner; Hugh Paynter, Partner in

the Sydney Disputes practice of Herbert Smith Freehills, and; Niv Tadmore, Partner, Clayton Utz.

SEMINAR: 1 May 2017

International Organisations: implementing Tax

Reforms in Developing Countries

Professor Lee Burns

Professor Lee Burns discussed the role that international organisations play in developing and

implementing tax reforms in developing countries. Lee talked particularly about BEPS

implementation in developing countries.

Lee has worked on tax reforms in developing countries for over 25 years as part of the technical

assistance programs of international organisations, particularly the International Monetary Fund

(IMF) and World Bank (WB).

Annual Tax Directors Lunch: 6 September 2017

Tax Lunch with Mentors, International Students and Special Guest, Professor Michael

Littlewood

Tax mentors and international students were invited to attend lunch with the Tax Group Directors

and special guest Professor Michael Littlewood. This is an annual event by invitation only and

provides an opportunity for students to meet academics and industry professionals.

Tax Group | Annual Report

12

SEMINAR: 7 September 2017

Using New Zealand Trusts to Escape Other Countries’

Taxes

Professor Michael Littlewood

Abstract: In recent years numerous foreigners (including some Australians, a Malaysian playboy

billionaire, a Maltese politician, and the manager of an English premier league football club) have set

up trusts in New Zealand. This would appear to have enabled them to escape tax in their home

country and perhaps also to conceal the proceeds of crime. In 2017 the government amended the

law with a view to preventing such abuses, but what happened to the trusts already established and

the hundreds of billions of dollars’ worth of assets they held remains unclear.

Speaker: Michael Littlewood is a Professor in the Faculty of Law at the University of Auckland. He is a

New Zealander but has spent many years in Hong Kong. He has degrees in law and politics from the

University of Auckland and a doctorate in tax law from the University of Hong Kong. He is admitted

as a barrister and solicitor in New Zealand, as a solicitor in England and Wales and as a solicitor in

Hong Kong. He is an authority on New Zealand tax law, Hong Kong tax law, tax policy and tax history.

Much of his work has been in the fields of tax planning, tax avoidance and international tax. His work

has been published and cited in leading journals in New Zealand, the US, the UK, Australia and Hong

Kong. He is a fulltime academic but has also from time to time provided advice to business interests

and to the governments of several countries.

SEMINAR: 2 November 2017

Are We All Equal in New Zealand?

Professor Lisa Marriott

Lisa’s presentation examined situations in New Zealand where individuals who are least advantaged

will be treated more punitively than those who are most advantaged. Examples of investigations,

prosecutions and sentencing from cases of tax evasion and welfare fraud will be used for illustration,

together with approaches to tax and welfare debt management. The presentation also highlighted

the different definitions used for tax and welfare purposes that lead to different outcomes.

Lisa Marriott is Professor of Taxation at Victoria University’s School of Accounting and Commercial

Law. Her research interests include social justice and inequality, and the behavioural impacts of

taxation. Lisa has worked in the private sector in the UK and the public sector in New Zealand. Since

2008 she has worked in academia.

Tax Group | Annual Report

13

Publications

Books (authored and edited)

Stewart, Miranda (ed) Tax, Social Policy and Gender: Rethinking Equality and Efficiency (2017) ANU

Press: Canberra.

Research Book Chapters

Edwards, Meredith and Stewart, Miranda, ‘Pathways and Processes towards a Gender Equality

Policy’ in Stewart, Miranda (ed) Tax, Social Policy and Gender: Rethinking equality and

efficiency (2017) ANU Press: Canberra, 325-348

Jogarajan, Sunita, ‘The "Great Powers" and the Development of the 1928 Model Tax Treaties’ in

Harris, Peter (ed) Studies in the History of Tax Law (2017) Cambridge University Press:

Cambridge Vol. 8, 341-362

Kobetsky, Michael, ‘Intra-Group Services’, United Nations, Practical Manual on Transfer Pricing for

Developing Countries (2017) United Nations: New York, B.4. 229-271

Kobetsky, Michael, ‘Cost Contribution Arrangements’ United Nations, Practical Manual on Transfer

Pricing for Developing Countries (2017) United Nations: New York, B.6. pp 319-338

Stewart, Miranda, ‘Gender Inequality in Australia's tax-transfer system’ in Stewart, Miranda

(ed) Tax, Social Policy and Gender: Rethinking equality and efficiency (2017) ANU Press:

Canberra, 1-34

Stewart, Miranda, Voitchovsky, Sarah and Wilkins, Roger ‘Women and top incomes in Australia in

Stewart, Miranda (ed) Tax, Social Policy and Gender: Rethinking equality and efficiency (2017)

ANU Press: Canberra, 257-292

Stewart, Miranda ‘The Doctrine of Sham and Tax Avoidance’ in Hashimzade N and Epifantseva Y

(eds) The Routledge Companion to Tax Avoidance Research (2017) Routledge: UK

Stewart, Miranda ‘Two Ideas for Renewal of Australia’s Fiscal Federal Democracy’ in Brown et al

(ed) A People’s Federation for the 21

st

Century (2017) Federation Press: Sydney, 164-182

Stewart, Miranda (2017) ‘Australia’s Hybrid International Tax System: A Limited Focus on Tax and

Development’ in Brown, Karen B (ed) Taxation and Development – A Comparative Study (2017)

Springer: New York, 17-42

Revised Books

Cooper, Graeme, Dirkis, Michael, Stewart, Miranda, Vann, Richard Income Taxation: Commentary

and Materials (2017, 8

th

ed) Thomson Reuters: Sydney

Sadiq, Kerrie, Cynthia Coleman, R Hanegbi, Jogarajan, Sunita, Krever, Rick, W Obst, J Teoh, Ting,

Antony, Principles of Taxation Law (2017) Thomson Reuters: Sydney

Tax Group | Annual Report

14

Taylor, John, Walpole, Michael, Burton, Mark, Ciro, T and Murray, Ian, Understanding Taxation Law

2017 (2017) LexisNexis: Sydney

Refereed Journal Articles

Burton, Mark, A Review of Judicial References to the Dictum of Jordan CJ, Expressed in Scott v

Commissioner of Taxation, in Elaborating the Meaning of 'Income' for the Purposes of the

Australian Income Tax. Journal of Australian Taxation. 19. 2017

Emery, Joel and Stewart, Miranda, The Taxing Challenge of Digital Currency. Journal of Banking and

Finance - Law and Practice. 28. 2017

Ingles, David and Stewart, Miranda, Reforming Australia's Superannuation Tax System and the Age

Pension to Improve Work and Savings Incentives. Asia & The Pacific Policy Studies. 4. 2017

doi:

10.1002/app5.184

Other Journal Articles, Reports and Working Papers

Godber, P and Stewart, Miranda ‘Speed dating in the new tax era: the BEPS Convention kicks off’

(2017) The Tax Specialist 16-27

International Monetary Fund, Selected Issues Country Report: Indonesia (27 December 2016) IMF

Country Report No. 17/48 (70 pages), published February 2017. Prepared by Jongsoon Shin, Hui

Jin, Thornton Matheson, Narine Nersesyan, Michael Kobetsky, Yinqiu Lu, Juul Pinxten, Pablo

Ariel Acosta, and Changqing Sun

Media, Blogs and Commentary

• Ingles, David, Murphy, Chris and Stewart, Miranda How Australia can afford to cut company tax, 17

November 2017, Asia Pacific Policy Forum.

• Stewart, Miranda New Tax Treaty Will Close Loopholes That Allow Multinationals to Avoid Tax, 16

June 2017.

• Stewart, Miranda Budget Forum 2017/Women in Economics: Tax, Transfers and Budget Fairness, 30

May 2017.

• Interview on Q&A (ABC) – Miranda Stewart

https://taxpolicy.crawford.anu.edu.au/news-events/news/10069/miranda-stewart-qa

Tax Group | Annual Report

15

Tax Discussion Group

The Tax Group assists with the coordination of the Tax Discussion Group led by Terry Murphy QC.

The discussion group meets monthly to discuss current and topical taxation issues. Members include

practitioners and academics associated with the Melbourne Law Masters Program.

TAX DISCUSSION GROUP TOPICS 2017

February

Gareth Redenbach - Source of Income.

March

Patrick Broughan - Division 974.

April

Dan Butler - Superannuation Reform: key strategies and traps to be addressed before

and after 30 June 2017.

June

Peter Gillies - Division 7A, UPEs and Sub-Trusts.

July

Gareth Redenbach - The OECD's Multilateral Instrument, with special guest Greg

Wood and Wingchun Yung (Treasury) commenting on Australia's approach.

August

Terry Murphy - Section 295-550 of the Income Tax Assessment Act-Non-arms Length

Income of a Complying Superannuation Fund

September

Gareth Redenbach - Topic: 1. An overview of investment vehicles, deductibility and

offset incentives applying to Division 360 and Division 61 investments; Topic 2. Real

world ratio and points based compliance issues; and Topic 3. Flow through of offset

entitlements to partners and beneficiaries of trusts under Divisions 360 and 61.

October

Yina Tang presenting on Foreign Residents and Capital Gains.

November

Round table tax topics